- 新年快乐

- 招财进宝

- 生意兴隆

- 岁岁平安

- 财源广进

- 马到成功

- 發發發!!

Trading is all about probability. Be it Financial or Technical Analysis. Remember, Trade Wise, Trade smart & be responsible for every trade.

Thursday 30 January 2014

Tuesday 28 January 2014

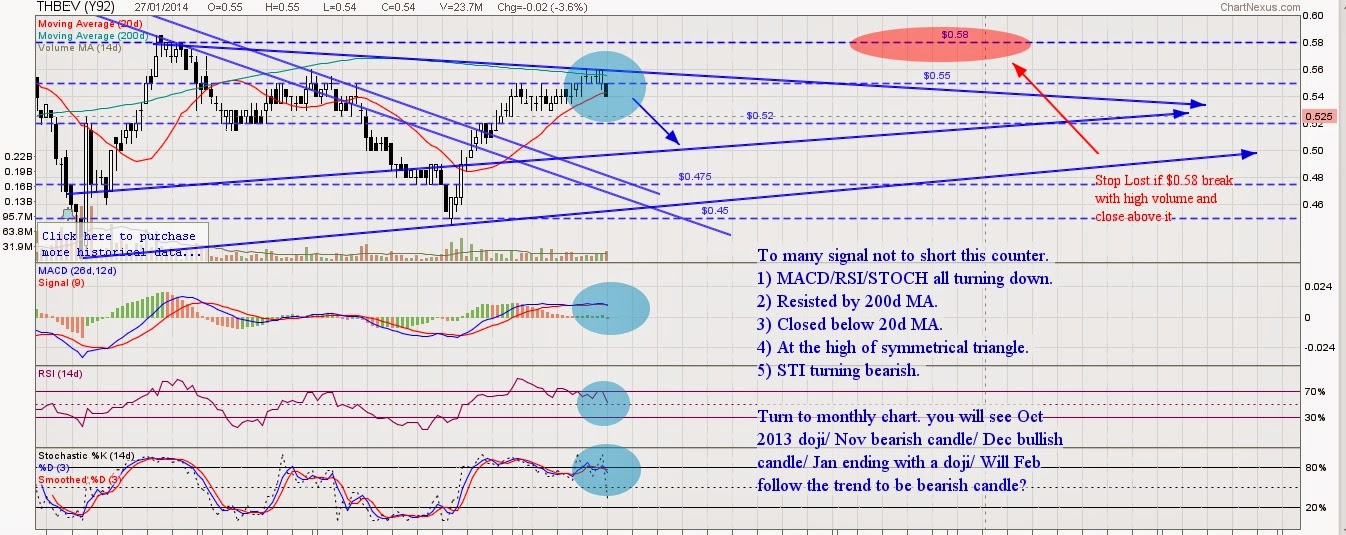

stock chart: YangZiJiang/THBEV

Congrats to all those who actually benefited from my chart.

GLP: NO action, price closed @ $2.86

Noble: Hit Final profit $0.92

Kepland: Resisted by $3.31

GentingSP: Hit first target $1.42, shall see $1.37 soon

YZJ: Please monitor carefully for those who long this counter. In weekly chart, YZJ is been resisted by $1.24 and today candlestick closed below the bull trend. However we know maybe it was due to STI which closed -33point caused the drop. So please do watch out carefully if this week candlestick fall and closed below 20d MA. It mean the confirmation bearish candlestick is formed after a doji! If it crossed below $1.125 (Double top will only form after it cross below), the next support will be around $1.025 where by around 50d MA.

THBEV: Just way too many signal not to short this counter.

Entry @ current price. $0.54

SL @ $0.58 (Must cut if high vol come in)

Target. $0.505/$0.475

You are remind to trade base on your own risk. Plan and Trade well :)

GLP: NO action, price closed @ $2.86

Noble: Hit Final profit $0.92

Kepland: Resisted by $3.31

GentingSP: Hit first target $1.42, shall see $1.37 soon

YZJ: Please monitor carefully for those who long this counter. In weekly chart, YZJ is been resisted by $1.24 and today candlestick closed below the bull trend. However we know maybe it was due to STI which closed -33point caused the drop. So please do watch out carefully if this week candlestick fall and closed below 20d MA. It mean the confirmation bearish candlestick is formed after a doji! If it crossed below $1.125 (Double top will only form after it cross below), the next support will be around $1.025 where by around 50d MA.

THBEV: Just way too many signal not to short this counter.

Entry @ current price. $0.54

SL @ $0.58 (Must cut if high vol come in)

Target. $0.505/$0.475

You are remind to trade base on your own risk. Plan and Trade well :)

Thursday 23 January 2014

Stock chart: GLP/Noble/KepLand/GentingSP

A quick review of those previous chart I plotted.

As i mentioned earlier, GLP have to cross $2.95 in order to see the $3/$3.03. However $2.95 resistance is way too strong and currently STI break below 3120. To be safe than sorry. I will suggest no action to be taken till STI find it support area or once $2.95 break through.

Noble pointed out earlier too. Bull & Bear have been fighting past few days till it finally break down and successfully formed H&S. Congrats those who shorted @ $1.04. Current target $0.97 & $0.92 (final, mirror image).

Kepland on the weekly chart i pointed out to target $2.88. Of course is hard to have one way trip in a stock market unless financial crisis or company bad news. So for those who still believed there is room for kepland to continue to plunge, they may wish to short it @ the current price (since STI drop below 3120) or wait for it to pullback $3.37/$3.4.

Congrats those who shorted Genting SP @ $1.47 or those who shorted once STI 3120 give way. Now with the current high volume, let continue to hold on and shall see whether it able to reach the first target $1.42 follow by $1.37

Please take note next week due to CNY. Trading days will be reduce and volume may not be that strong.

You are remind to trade base on your own risk. Plan and Trade well :)

As i mentioned earlier, GLP have to cross $2.95 in order to see the $3/$3.03. However $2.95 resistance is way too strong and currently STI break below 3120. To be safe than sorry. I will suggest no action to be taken till STI find it support area or once $2.95 break through.

Noble pointed out earlier too. Bull & Bear have been fighting past few days till it finally break down and successfully formed H&S. Congrats those who shorted @ $1.04. Current target $0.97 & $0.92 (final, mirror image).

Kepland on the weekly chart i pointed out to target $2.88. Of course is hard to have one way trip in a stock market unless financial crisis or company bad news. So for those who still believed there is room for kepland to continue to plunge, they may wish to short it @ the current price (since STI drop below 3120) or wait for it to pullback $3.37/$3.4.

Congrats those who shorted Genting SP @ $1.47 or those who shorted once STI 3120 give way. Now with the current high volume, let continue to hold on and shall see whether it able to reach the first target $1.42 follow by $1.37

Please take note next week due to CNY. Trading days will be reduce and volume may not be that strong.

You are remind to trade base on your own risk. Plan and Trade well :)

Sunday 19 January 2014

Market Update: 19 Jan 2014

Currently STI is drifting sideways since past 2 week. However

sideways also mean there are counters going either way. So I will update 2 counters

such as GLP & GentingSP. Let take a look.

GLP on the bull trend. Break $2.95 will see $3/$3.03. If STI going bullish, perhaps you can consider to long this counter. Plus in weekly chart. The last candlestick closed on 20MA.

Genting SP inside the symmetrical triangle. I draw the symmetrical triangle base on the closing price. (Change it to line chart to see it clearly). Short @ current price (or you can wait till STI break 3120). Cut @ $1.525. 3 different target to aim.

You are remind to trade base on your own risk. Plan and Trade well :)

Thursday 16 January 2014

Stock chart: Biosensors/Jardine CC

Congrats to those who believe and trade base on the my chart :)

You are remind to trade base on your own risk. Plan and Trade well :)

Sunday 12 January 2014

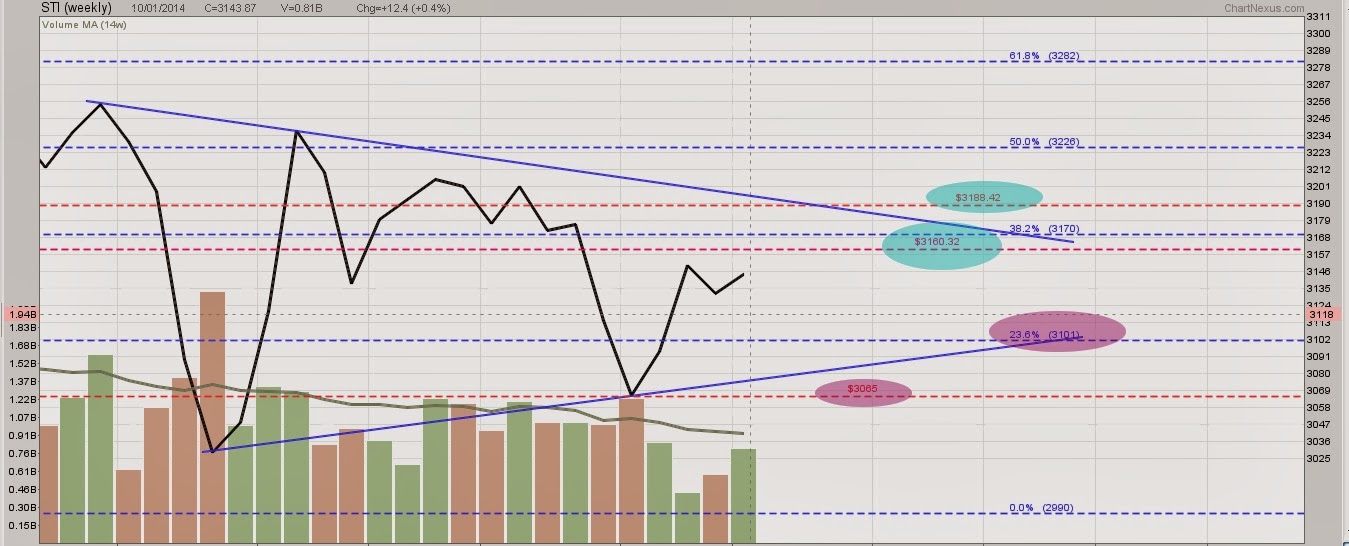

Market Update: 12 Jan 2014

My stand still remain the same for STI since i mentioned last week. In weekly chart, we can see that STI still ranging in between a

symmetrical triangle. So do monitor 3100 and 3065 for support. Break

3225 will eventually out from the bearish trend.

Friday 10 January 2014

Stock Chart: Del Monte

Del Monte show good volume with small gap this morning. maybe breakout coming soon? Anyway i seldom play penny counter. Just post for a self study purpose. If you wish to trade, remember to plan for an exit route. Plan and trade well :)

Tuesday 7 January 2014

Stock Chart: Noble/Kepland/Jardine C&C

Noble closing candlestick dont look pretty good. Perhaps H&S is coming soon.

Kepland weekly chart. I'm just doing a case study of how this counter will pend out. If you are keen to trade, do remember to trade with your game plan

Jardine C&C, elephant stock counter, showing sign of bullish with supported by 20/50/100d MA. I have indicate the entry, Stoplost and target for this counter.

You are remind to trade base on your own risk. Plan and Trade well :)

Kepland weekly chart. I'm just doing a case study of how this counter will pend out. If you are keen to trade, do remember to trade with your game plan

Jardine C&C, elephant stock counter, showing sign of bullish with supported by 20/50/100d MA. I have indicate the entry, Stoplost and target for this counter.

You are remind to trade base on your own risk. Plan and Trade well :)

Stock Chart: YangZiJiang

YZJ in weekly chart still show uptrend by judging 20w MA. However base on daily chart, as long as the price trade below $1.18 (below 50d MA), chances it may hit $1.115 and perhaps $1.055 if $1.115 break successfully.

Plan and Trade Well.

Plan and Trade Well.

Sunday 5 January 2014

Market Update: 05 Jan 2014

Welcome back everyone and let start fresh for year 2014.

We shall start with STI index. I know market actually open on 2nd Jan 2014. However to me i prefer to start everything from the beginning of the week. As i stated on 29 Dec 2013, I mentioned that do watch out STI may have the chance to cover back the gap @ 3160 and back to square one 3188 where sti open on 2013. Now where will STI head to in the following week. In weekly chart, we can see that STI still ranging in between a symmetrical triangle. So do monitor 3100 and 3065 for support. Break 3225 will eventually out from the bearish trend.

Next we shall take a look at HSI. Gap down on market reopen after holiday. Shall we say HSI forming H&S? Anyway do monitor once it break 22614 with high volume. Higher chance there will be a mirror image from the H&S. Target around 21663. Becareful HSI may eventually cover the gap before it continue its bearish trend.

Noble counter seem interesting to put under your watch list. As i said earlier in my previous noble post, I mention it will pullback around $1.065/$.108 and continue it's long term downtrend. Now we shall watch how noble pend out to be in the following week. Will H&S be successfully form after this week? Do monitor $1 as the support carefully. High chance mirror image will be form :)

After all please do plan and trade wisely for the start of the year.

Last but not least, I wish everyone a green and greener P&L for year 2014.

We shall start with STI index. I know market actually open on 2nd Jan 2014. However to me i prefer to start everything from the beginning of the week. As i stated on 29 Dec 2013, I mentioned that do watch out STI may have the chance to cover back the gap @ 3160 and back to square one 3188 where sti open on 2013. Now where will STI head to in the following week. In weekly chart, we can see that STI still ranging in between a symmetrical triangle. So do monitor 3100 and 3065 for support. Break 3225 will eventually out from the bearish trend.

Next we shall take a look at HSI. Gap down on market reopen after holiday. Shall we say HSI forming H&S? Anyway do monitor once it break 22614 with high volume. Higher chance there will be a mirror image from the H&S. Target around 21663. Becareful HSI may eventually cover the gap before it continue its bearish trend.

Noble counter seem interesting to put under your watch list. As i said earlier in my previous noble post, I mention it will pullback around $1.065/$.108 and continue it's long term downtrend. Now we shall watch how noble pend out to be in the following week. Will H&S be successfully form after this week? Do monitor $1 as the support carefully. High chance mirror image will be form :)

After all please do plan and trade wisely for the start of the year.

Last but not least, I wish everyone a green and greener P&L for year 2014.

Subscribe to:

Posts (Atom)