I will be sharing HSI, STI, GentingSP, GLP & Review UOL chart as for this coming week.

As for those who follow my blog closely. I believed I have pointed out the hammer showing in the weekly chart last week. Congrats to those who went long in HSI futures. Good $$. Let's hope it will reach the first target. (for those who missed the chance to enter since last week, do not chase the price. Is fine to miss a boat than capsize it)

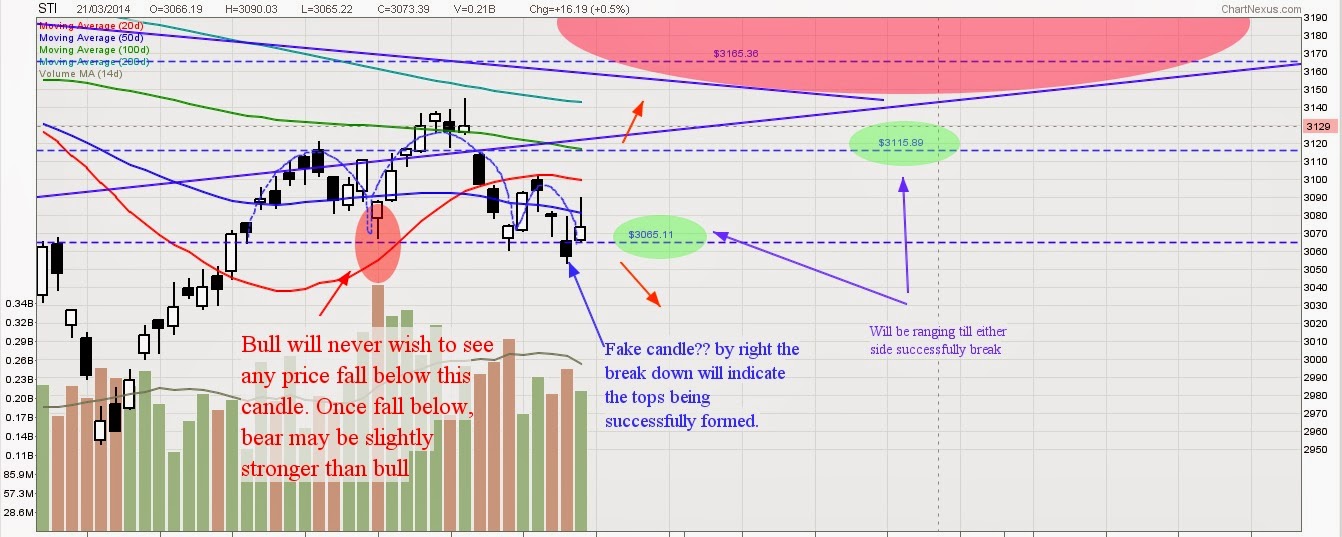

STI: After saying it will be in ranging mode till either "green" zone give way, Last week the bull really step in! Once 3115 broke up, the bull run all the way to hit the first resistance @ 3165. As for this coming week, let monitor whether the bull will continue its way to 3200 or having a small pull back since it has been running for 6 continuous days.

Genting SP: A starting signal of bull stepping in. EP: Above 1.33, SL: $1.29: TP 3target show in the chart.

GLP: Will this anti trend work out? As we can see usually for a bearish trend to reverse into bull trend, we need to catch the crumbs of bull before the price run off. I have circle out how consolidation workout over GLP. Do monitor closely and plan your RR wisely if you really wish to enter an anti-trend position.

UOL: For those who shorted @ $6 or below (by following my previous call) I hope you have already cut lost after I mentioned UOL turning bullish since last week before it hit the stop lost i given @ $6.22

Currently UOL forming inverse H&S.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall: STI have been bullish for the past few days, If you feel uncomfortable to enter any counter right now worry the pullback of STI will drag down your counters, do enter after a small pullback in STI will be safer.

Trading is all about probability. Be it Financial or Technical Analysis. Remember, Trade Wise, Trade smart & be responsible for every trade.

Sunday 30 March 2014

Sunday 23 March 2014

Market Update: 23 March 2014

This week. Let us review the same index on DJI, HSI, and STI plus review back all the counters which i mentioned on 12 march 2014.

DJI: By looking @ DJI, that long wick candlestick should tell you something for the upcoming week. We need another bearish candle to come in and act as a confirmation after that shooting stars candlestick.

HSI: Remember on the 9 march I did indicate to monitor closing after HSI showing pendant triangle? As for now under weekly chart, Hammer candlestick formed. Will this act as a trend reverse?

STI: Fake candlestick on the 20th March? Anyway STI maybe in ranger mood till either side of the green circle breakthrough. (very high chance it may go up next week if all the 3banks showing pullback sign)

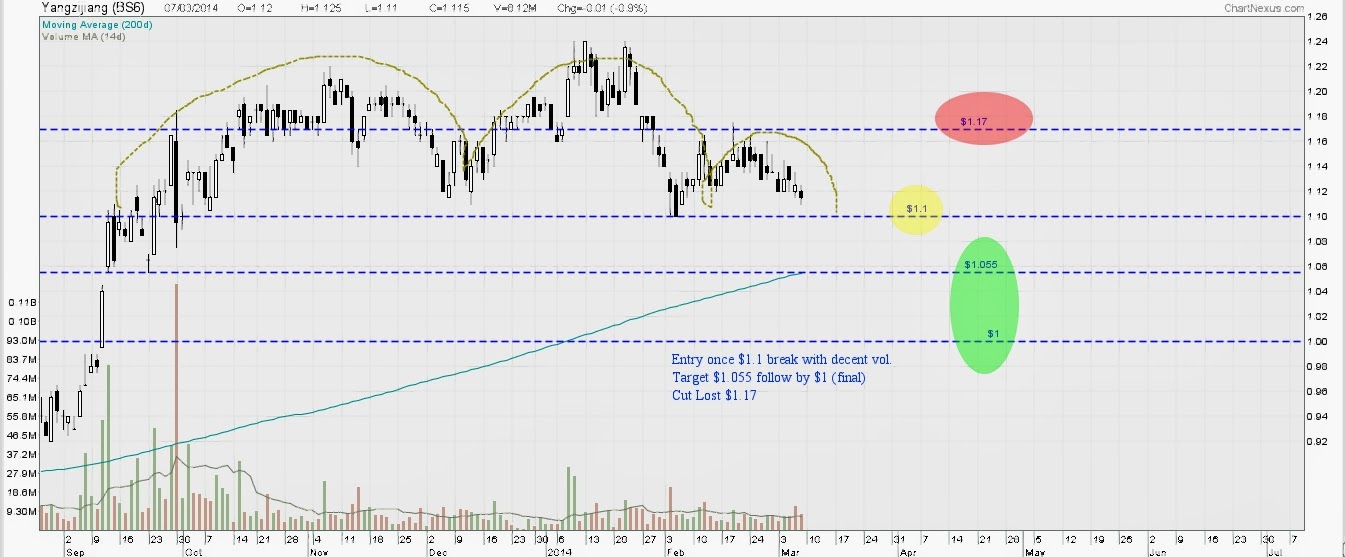

YZJ: Nth much to say. consolidate and supported by 200d MA. If you not feeling confident to hold on to your short position, Just book in your profit. Money in pocket will never be wrong.

UOL: For those who trigger their short @ $6, You remind to watch this counter closely. Since there are sign of bullish candle showing for the last few days. It may be trying to form inverse H&S as $6.22 maybe the resistance line.

Cordlife: For those who have trigger directly after i mention on my blog the next following day. I hope by now you have already cut lost this counter @ $1.18. I'm sorry for the bad call.

Unionmet: Yet another bad call. I'm still trying my best to practice on penny counter.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall: From the charts, as you can see i do not own a crystal ball to tell me what will happen in the coming week. All i have to do is strictly follow my trading plan and react as what the candle show and tell us. I'm sorry for those who have follow and triggered the bad trade.

DJI: By looking @ DJI, that long wick candlestick should tell you something for the upcoming week. We need another bearish candle to come in and act as a confirmation after that shooting stars candlestick.

HSI: Remember on the 9 march I did indicate to monitor closing after HSI showing pendant triangle? As for now under weekly chart, Hammer candlestick formed. Will this act as a trend reverse?

STI: Fake candlestick on the 20th March? Anyway STI maybe in ranger mood till either side of the green circle breakthrough. (very high chance it may go up next week if all the 3banks showing pullback sign)

YZJ: Nth much to say. consolidate and supported by 200d MA. If you not feeling confident to hold on to your short position, Just book in your profit. Money in pocket will never be wrong.

UOL: For those who trigger their short @ $6, You remind to watch this counter closely. Since there are sign of bullish candle showing for the last few days. It may be trying to form inverse H&S as $6.22 maybe the resistance line.

Cordlife: For those who have trigger directly after i mention on my blog the next following day. I hope by now you have already cut lost this counter @ $1.18. I'm sorry for the bad call.

Unionmet: Yet another bad call. I'm still trying my best to practice on penny counter.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall: From the charts, as you can see i do not own a crystal ball to tell me what will happen in the coming week. All i have to do is strictly follow my trading plan and react as what the candle show and tell us. I'm sorry for those who have follow and triggered the bad trade.

Wednesday 12 March 2014

Stock chart: YangZiJiang/UOL/Unionmet/Cordlife

YZJ: Dear readers, so did you follow the trade? Congrats for those who trigger the trade after $1.1 is break. Our first target will be reaching real soon @ $1.055. In the mean time, I will shift down my SL to $1.12 or BE if you feel unsafe. Lets pray it will reach our final target :)

UOL: Trade solely base on bearish trend line. Those who wish more confirmation can wait till $5.88 break down & those who are more willing to take risk able to enter straight.

Cordlife: Finally breakdown $1.16. Will this be the first sign showing bear have board this counter?

Enter @ any price you like, SL strictly @ $1.18

Unionmet: This is strictly for me to practice and monitor more on penny counter. I never like pennies but i'm willing to practice and love it more. SL: $0.061. The rest is up to individual RR.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall: STI seem like having hard time to break through 200d MA. Be ware if you intend to long any counter. As for IndoAgri which i pointed out on my last post, I will remove the counter and continue to monitor more before enter. Cos 0.965 seem hard for it to reach and break.

UOL: Trade solely base on bearish trend line. Those who wish more confirmation can wait till $5.88 break down & those who are more willing to take risk able to enter straight.

Cordlife: Finally breakdown $1.16. Will this be the first sign showing bear have board this counter?

Enter @ any price you like, SL strictly @ $1.18

Unionmet: This is strictly for me to practice and monitor more on penny counter. I never like pennies but i'm willing to practice and love it more. SL: $0.061. The rest is up to individual RR.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall: STI seem like having hard time to break through 200d MA. Be ware if you intend to long any counter. As for IndoAgri which i pointed out on my last post, I will remove the counter and continue to monitor more before enter. Cos 0.965 seem hard for it to reach and break.

Sunday 9 March 2014

Market Update: 09 March 2014

Dear readers,

Its been exactly 1month since my last post. I'm back once again after my major surgery and will continue to provide my own view on the market. I will always treat this blog as part of my trading journal to understand more about TA. Please do continue to support.

Anyway, we shall look into next week forecast movement for certain index and STI counters.

Let's begin with DJI:

DJI: Previously I have indicated a certain level to watch out in order to know which way will DJI move. Currently, we are eying DJI to reach the previous high to determine whether it will continue to soar for next record high or forming a double top. Continue to monitor closely.

(not advisable to trade since RR is not worth currently)

HSI currently stuck inbetween the mid price level which i indicate earlier before and forming pendant triangle chart pattern. Monitor closely to see which way will it break out to determine bull or bear.

(not advisable to trade, need more confirmation)

STI: Base on my last STI forecast, I did say STI will be going ahead towards 3100 and we shall monitor from there whether it will continue to break rest of the resistance @ 3165 & 3200 in the following week

IndoAgri: As we know commodities have been running since last week. OLAM, Noble, Wilmar, FirstRes. Now the slow and lack off will belong to IndoAgri. Will IndoAgri able to break through the bearish trend and enjoy the bull meat? Double bottom already showing first sign with good volume. Once $0.965 break we shall see $1.13. Rmb to do your RR before enter into this position.

YZJ: Marine Counter don't seem to be doing good. YZJ double top formed previously. Currently it show another chart pattern of cup and handle. If $1.1 break down, we shall see $1.055 (resisted by 200dMA), follow by final target $1.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall, do remember the "war" between Russia & Ukraine will cause overnight panic and drag down the market plus certain counter. Do remember to trade those strong counters or control your position size which will able to withstand those "noise" period.

Its been exactly 1month since my last post. I'm back once again after my major surgery and will continue to provide my own view on the market. I will always treat this blog as part of my trading journal to understand more about TA. Please do continue to support.

Anyway, we shall look into next week forecast movement for certain index and STI counters.

Let's begin with DJI:

DJI: Previously I have indicated a certain level to watch out in order to know which way will DJI move. Currently, we are eying DJI to reach the previous high to determine whether it will continue to soar for next record high or forming a double top. Continue to monitor closely.

(not advisable to trade since RR is not worth currently)

HSI currently stuck inbetween the mid price level which i indicate earlier before and forming pendant triangle chart pattern. Monitor closely to see which way will it break out to determine bull or bear.

(not advisable to trade, need more confirmation)

STI: Base on my last STI forecast, I did say STI will be going ahead towards 3100 and we shall monitor from there whether it will continue to break rest of the resistance @ 3165 & 3200 in the following week

IndoAgri: As we know commodities have been running since last week. OLAM, Noble, Wilmar, FirstRes. Now the slow and lack off will belong to IndoAgri. Will IndoAgri able to break through the bearish trend and enjoy the bull meat? Double bottom already showing first sign with good volume. Once $0.965 break we shall see $1.13. Rmb to do your RR before enter into this position.

YZJ: Marine Counter don't seem to be doing good. YZJ double top formed previously. Currently it show another chart pattern of cup and handle. If $1.1 break down, we shall see $1.055 (resisted by 200dMA), follow by final target $1.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall, do remember the "war" between Russia & Ukraine will cause overnight panic and drag down the market plus certain counter. Do remember to trade those strong counters or control your position size which will able to withstand those "noise" period.

Subscribe to:

Posts (Atom)