Dear readers,

Its been exactly 1month since my last post. I'm back once again after my major surgery and will continue to provide my own view on the market. I will always treat this blog as part of my trading journal to understand more about TA. Please do continue to support.

Anyway, we shall look into next week forecast movement for certain index and STI counters.

Let's begin with DJI:

DJI: Previously I have indicated a certain level to watch out in order to know which way will DJI move. Currently, we are eying DJI to reach the previous high to determine whether it will continue to soar for next record high or forming a double top. Continue to monitor closely.

(not advisable to trade since RR is not worth currently)

HSI currently stuck inbetween the mid price level which i indicate earlier before and forming pendant triangle chart pattern. Monitor closely to see which way will it break out to determine bull or bear.

(not advisable to trade, need more confirmation)

STI: Base on my last STI forecast, I did say STI will be going ahead towards 3100 and we shall monitor from there whether it will continue to break rest of the resistance @ 3165 & 3200 in the following week

IndoAgri: As we know commodities have been running since last week. OLAM, Noble, Wilmar, FirstRes. Now the slow and lack off will belong to IndoAgri. Will IndoAgri able to break through the bearish trend and enjoy the bull meat? Double bottom already showing first sign with good volume. Once $0.965 break we shall see $1.13. Rmb to do your RR before enter into this position.

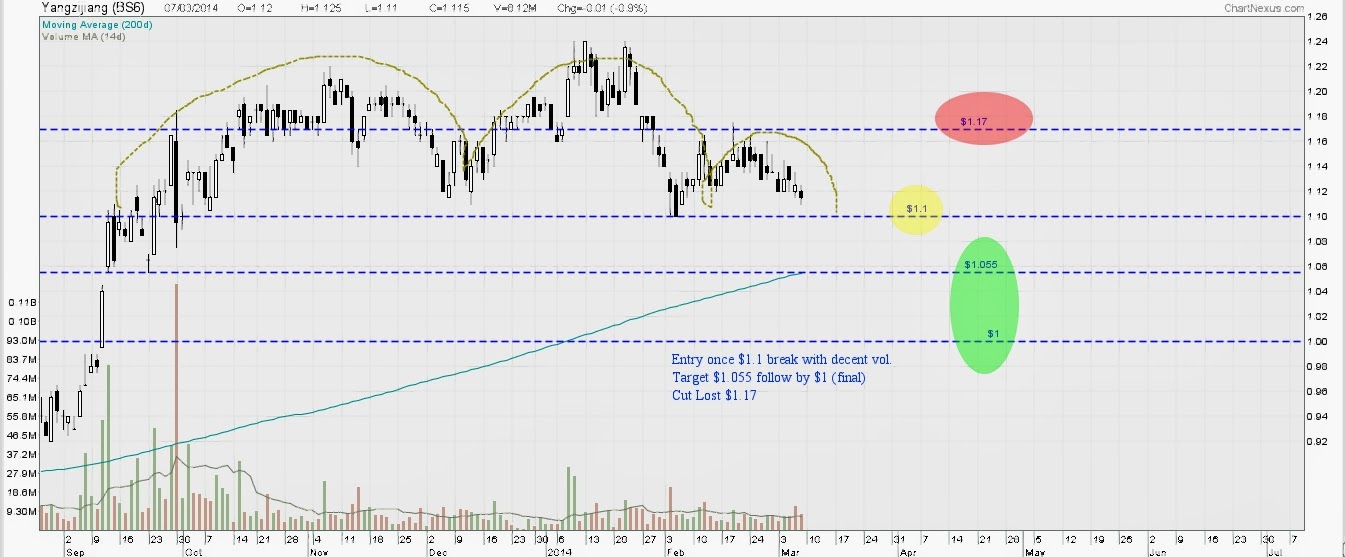

YZJ: Marine Counter don't seem to be doing good. YZJ double top formed previously. Currently it show another chart pattern of cup and handle. If $1.1 break down, we shall see $1.055 (resisted by 200dMA), follow by final target $1.

You are remind to trade base on your own risk. Plan and Trade well :)

Overall, do remember the "war" between Russia & Ukraine will cause overnight panic and drag down the market plus certain counter. Do remember to trade those strong counters or control your position size which will able to withstand those "noise" period.

No comments:

Post a Comment