Welcome back everyone and let start fresh for year 2014.

We shall start with STI index. I know market actually open on 2nd Jan 2014. However to me i prefer to start everything from the beginning of the week. As i stated on 29 Dec 2013, I mentioned that do watch out STI may have the chance to cover back the gap @ 3160 and back to square one 3188 where sti open on 2013. Now where will STI head to in the following week. In weekly chart, we can see that STI still ranging in between a symmetrical triangle. So do monitor 3100 and 3065 for support. Break 3225 will eventually out from the bearish trend.

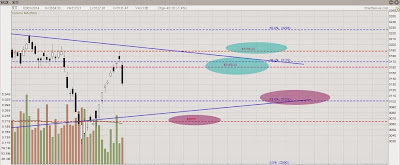

Next we shall take a look at HSI. Gap down on market reopen after holiday. Shall we say HSI forming H&S? Anyway do monitor once it break 22614 with high volume. Higher chance there will be a mirror image from the H&S. Target around 21663. Becareful HSI may eventually cover the gap before it continue its bearish trend.

Noble counter seem interesting to put under your watch list. As i said earlier in my previous noble post, I mention it will pullback around $1.065/$.108 and continue it's long term downtrend. Now we shall watch how noble pend out to be in the following week. Will H&S be successfully form after this week? Do monitor $1 as the support carefully. High chance mirror image will be form :)

After all please do plan and trade wisely for the start of the year.

Last but not least, I wish everyone a green and greener P&L for year 2014.

No comments:

Post a Comment