Sell in May & Go away? Sound familiar?

I bet everyone have been keep on repeating this to stay away from the market.

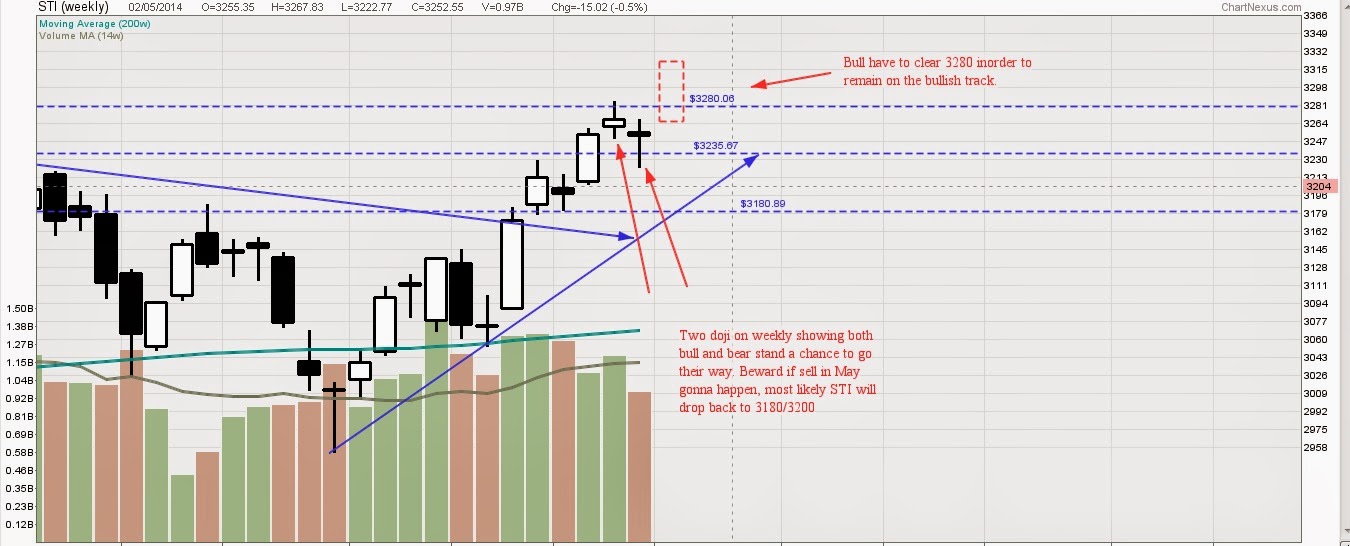

So does "sell in May" come true? If yes, will STI start to drop back towards 3200?

Lets review the chart

STI Weekly chart: As you can before "sell in May" reach, STI was on the bullish trend till end of Apr and Start of May formed 2 doji candle. This 2 doji beside factor in the rumor and also included those good/bad earning reports. If STI able to break 3280 with good vol, we shall target for 3310. If not 3200 follow by 3180 will still remain as the support.

HSI: Did mention earlier that no indication where HSI will go to. As for now, if 22080 break, lets target 21670. As i believe HSI still floating within the 3price range given way earlier.

Genting SP: Did mention if it break $1.345, our first target will be $1.39. However the price drop back after hitting $1.365 (the most) perhaps due to euro news? As for now, last friday price closed below both 20/50d MA. We shall monitor this carefully. For those who still keen to long genting, try to long @ the price near the stop lost. Maybe price range around $1.3-$1.310 will be good enough.

If $1.29 give way, Please cut!

GuocoLeisure: Trade with Moving average. Use 20d MA as the support. Tight Stop Lost is needed!

SuperGroup: Currently forming Bollinger Squeeze. Waiting for 9th of May dividend to decide the direction and please do watch out on 26th of May offering 1 for 1.

United Engineers: Trade with 20d Ma as support. Last friday candlestick may show as a reversal sign. Pay attention for those who keen on this counter

Overall: Earning report is over, May rumor is here, Most counter giving out dividend. Price may swing from one end to another. So please do trade carefully. If you are not sure and no confident on "MAY" market, take a break and go relax :)

You are remind to trade base on your own risk. Plan and Trade well :)

No comments:

Post a Comment